Don’t get too excited about ‘positive’ coal news

June 26, 2017 by Ken Ward Jr.

In this Oct. 17, 2014 file photo, a mural of a coal miner stands in an empty storefront as signs advertising vacant apartments and stores hang in the windows along the main business street in Cumberland, Ky. (AP Photo/David Goldman, File)

The Associated Press has a story out this morning about gains in coal production in the United States and in China:

The world’s biggest coal users — China, the United States and India — have boosted coal mining in 2017, in an abrupt departure from last year’s record global decline for the heavily polluting fuel and a setback to efforts to rein in climate change emissions.

Mining data reviewed by The Associated Press show that production through May is up by at least 121 million tons, or 6 percent, for the three countries compared to the same period last year. The change is most dramatic in the U.S., where coal mining rose 19 percent in the first five months of the year, according to U.S. Department of Energy data.

Coal’s fortunes had appeared to hit a new low less than two weeks ago, when British energy company BP reported that tonnage mined worldwide fell 6.5 percent in 2016, the largest drop on record. China and the U.S. accounted for almost all the decline, while India showed a slight increase.

The reasons for this year’s turnaround include policy shifts in China, changes in U.S. energy markets and India’s continued push to provide electricity to more of its poor, industry experts said. President Donald Trump’s role as coal’s booster-in-chief in the U.S. has played at most a minor role, they said.

Judging from the National Mining Association’s op-ed piece on the Daily Mail editorial page last week, this is just the kind of story the coal industry is looking for:

Coal has added about 2,000 direct jobs in the last year, with 1,700 just since December 2016. Mines are expanding and new ones are opening in Alabama, Colorado, Pennsylvania, Virginia and here in West Virginia.

Year-to-date production is up about 50 million tons, rail loadings are climbing despite a relatively mild winter, and power sector coal consumption climbed almost 23 percent in March, year to date. Both prices and exports are now expected to tick upward this year.

The Trump administration deserves some credit for this revival.

But not so fast … West Virginians might want to be a little careful before they get too excited about the coal rebound that political leaders keep hinting to coalfield residents is just around the next corner.

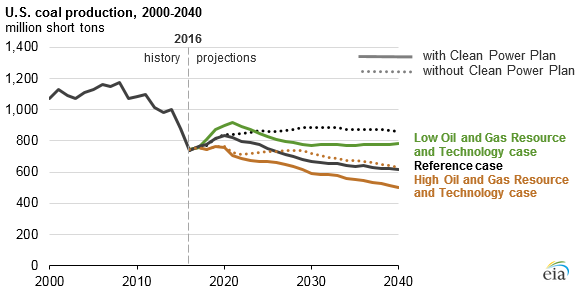

Take for example, the report from the U.S. Energy Information Administration’s latest “Energy Today” blog post, aptly headlined, “Future Coal Production Depends on Resources and Technology, Not Just Policy Choices.“

Sure, there may be some good news in there for the coal industry, for example, the discussion of what happens to future production projections when EIA includes the elimination of the Obama administration’s Clean Power Plan:

Coal generation and production are significantly higher in the No CPP case, which otherwise applies the Reference case resource and technology assumptions, as the existing fleet of coal-fired generators can be more fully utilized and fewer coal-fired generators are retired. As a result, in the No CPP case, coal production stabilizes at about 900 MMst from 2025 through 2040.

But read more closely, as the EIA goes on to say:

The adoption of High Oil and Gas Resource and Technology assumptions, which reflect a more optimistic outlook for natural gas supply—assuming lower natural gas prices compared with baseline resource and technology assumptions—lowers projected coal use. In the High Oil and Gas Resource and Technology case with the CPP, EIA forecasts that coal production declines to 500 MMst in 2040 as natural gas-fired generation outcompetes coal-fired generation in all years.

As shown by the smaller difference between the solid and dotted lines in the right-hand panel of the generation graphic than in the left-hand panel, the CPP is projected to have a smaller effect on coal-fired generation under high resource and technology assumptions than under Reference case resource and technology assumptions. Under the high resource assumptions, natural gas prices are considerably lower, making natural gas more likely to displace coal regardless of whether or not the CPP takes effect.

And for West Virginians, it’s even more important to dig into this more carefully, and look at the regional coal supply projections, and see that even without the Clean Power Plan, the EIA still is projecting trouble going forward for Appalachian coal producers. And as today’s EIA post said:

Few coal-fired power plants have been added in recent years, and in all of the AEO2017 cases, no new coal-fired generating capacity is added. In all cases, annual coal production remains below the 1,000 MMst level last seen in 2014.

Subscribe to the Coal Tattoo

Subscribe to the Coal Tattoo